Charitable Remainder Trust: A Comprehensive Guide to Securing Your Legacy and Supporting Causes You Care About

When planning for the future, many individuals seek solutions that provide financial security, reduce taxes, and create a lasting impact. A charitable remainder trust (CRT) is a powerful financial tool that combines these goals, offering a way to support charitable organizations while maintaining an income stream for yourself or your beneficiaries.

In this article, we’ll explore what a charitable remainder trust is, how it works, its benefits, and why it might be the right choice for your estate planning strategy.

What is a Charitable Remainder Trust?

A charitable remainder trust is an irrevocable trust designed to provide income to the trust’s beneficiaries for a specific period or lifetime, with the remainder of the trust assets eventually going to one or more designated charities. It’s an ideal solution for those who want to give back while enjoying tax advantages and financial flexibility.

CRTs are governed by Section 664 of the Internal Revenue Code, which establishes the rules for their operation and the tax benefits they offer. The trust splits its benefits between the donor (or other beneficiaries) and the charity, ensuring that both parties gain value over time.

How Does a Charitable Remainder Trust Work?

The process of setting up and operating a CRT involves several key steps:

Establishing the Trust:

The donor transfers assets such as cash, real estate, or appreciated securities into the trust. These assets are then managed by the trust to generate income.Income Distribution:

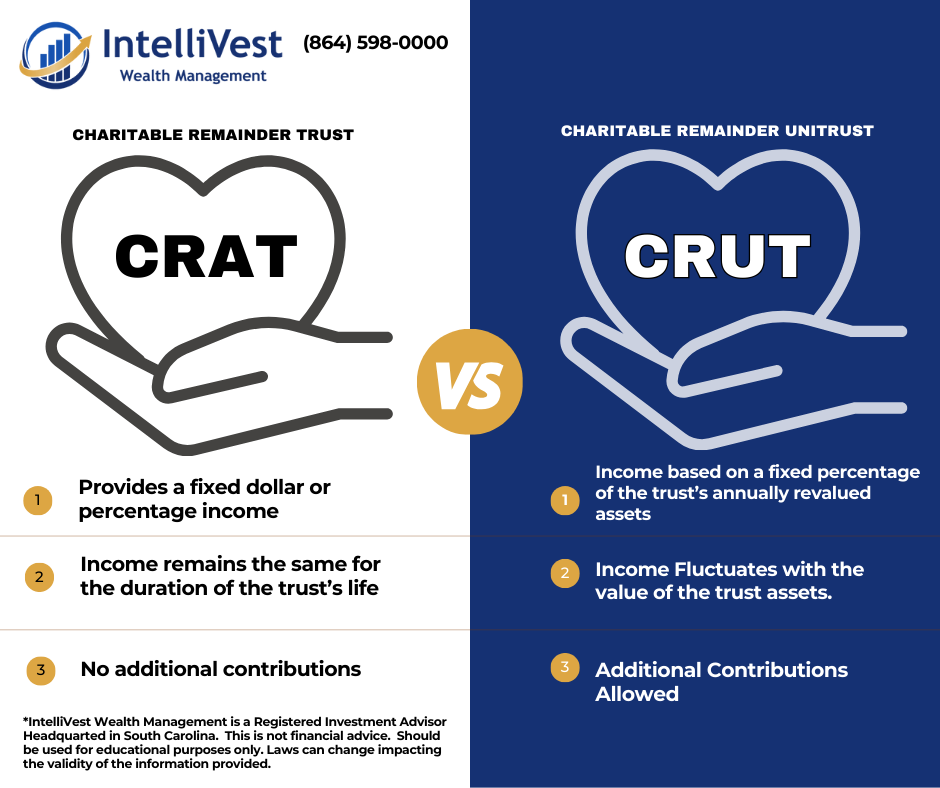

The trust pays out income to the beneficiaries (usually the donor or their family) for a specified term, which can last up to 20 years or for the lifetime of the beneficiaries. This income can be structured in two ways:Charitable Remainder Annuity Trust (CRAT): Pays a fixed dollar amount or fixed percentage amount.

Charitable Remainder Unitrust (CRUT): Pays a variable amount based on a percentage of the trust’s assets, revalued annually.

Charitable Remainder:

At the end of the trust term, the remaining assets are distributed to the designated charitable organizations.

Key Benefits of a Charitable Remainder Trust

A CRT offers several compelling advantages:

1. Income Stream for Beneficiaries

By placing assets into a CRT, you create a steady income stream for yourself or other beneficiaries. This can be especially beneficial for retirees seeking additional income or families planning for multigenerational wealth.

2. Significant Tax Benefits

Tax Deduction: Donors may receive an immediate charitable income tax deduction for the present value of the charitable remainder interest.

Avoid Capital Gains Taxes: If you fund the trust with appreciated assets, the CRT can sell them without incurring immediate capital gains taxes. This maximizes the value of the assets and increases the income potential.

Reduced Estate Taxes: Assets placed in the CRT are removed from your taxable estate, potentially reducing estate tax liabilities.

3. Philanthropic Impact

A CRT allows you to leave a meaningful legacy by supporting charities and causes that matter most to you. This impact can align with your values and inspire future generations to prioritize giving.

4. Flexibility in Asset Use

CRTs can accept a wide range of assets, including cash, publicly traded securities, real estate, and even closely held business interests. This versatility makes them an excellent option for individuals with diverse portfolios.

Who Should Consider a Charitable Remainder Trust?

While a CRT can benefit many people, it’s particularly advantageous for:

Individuals with highly appreciated assets looking to avoid hefty capital gains taxes.

Retirees seeking an additional income stream.

High-net-worth individuals aiming to reduce estate tax liabilities.

Philanthropists who want to support their favorite charities in a structured and impactful way.

Types of Charitable Remainder Trusts

As mentioned earlier, there are two primary types of CRTs:

1. Charitable Remainder Annuity Trust (CRAT):

Provides a fixed income each year.

Suitable for individuals seeking predictability in their income.

No additional contributions can be made after the trust is funded.

2. Charitable Remainder Unitrust (CRUT):

Offers income based on a fixed percentage of the trust’s annually revalued assets.

Income fluctuates with the value of the trust assets, which can grow over time.

Allows for additional contributions after the trust is established.

Steps to Create a Charitable Remainder Trust

Creating a CRT involves careful planning and professional guidance. Here’s a general roadmap:

Consult Financial and Legal Advisors:

Work with an experienced estate planning attorney and financial advisor to ensure the trust aligns with your goals.Select the Type of CRT:

Decide whether a CRAT or CRUT best suits your needs and financial circumstances.Choose Beneficiaries and Charities:

Identify who will receive the income stream and which charities will benefit from the remainder assets.Fund the Trust:

Transfer assets into the trust. Ensure these assets are suitable for the trust’s income-generation goals.Appoint a Trustee:

Select a reliable individual or institution to manage the trust and oversee distributions.Draft the Trust Document:

An attorney will prepare the necessary legal documentation to establish the CRT.

Charitable Remainder Trust vs. Other Trusts

While a CRT offers unique advantages, it’s essential to understand how it compares to other trust types:

Charitable Lead Trust (CLT): Opposite of a CRT, the CLT provides income to charities first, with the remainder going to the donor’s beneficiaries.

Revocable Living Trust: Unlike a CRT, this trust allows the donor to retain control over the assets and make changes.

Each trust serves distinct purposes, and selecting the right one depends on your financial and philanthropic goals.

Common Misconceptions About Charitable Remainder Trusts

“CRTs are only for the ultra-wealthy.”

While CRTs are popular among high-net-worth individuals, they can also benefit middle-income families with appreciated assets and philanthropic aspirations.

“I’ll lose control of my assets.”

Though CRTs are irrevocable, donors can structure them to retain income and designate beneficiaries, giving them partial control over how assets are used.

“It’s too complicated to set up.”

While CRTs require professional guidance, they are straightforward with the right team of advisors.

The Philanthropic Impact of Charitable Remainder Trusts

In addition to their financial benefits, CRTs empower donors to make a lasting difference. Charitable organizations rely on such planned giving arrangements to fund vital programs in education, healthcare, environmental conservation, and more.

By choosing a CRT, you can align your financial strategy with your values, ensuring that your legacy reflects the causes you care about most.

Is a Charitable Remainder Trust Right for You?

A charitable remainder trust is a versatile and impactful tool for estate planning, offering tax savings, income security, and the chance to give back meaningfully. If you’re considering a CRT, consult with financial and legal professionals to determine how it fits into your overall strategy.

Final Thoughts

A charitable remainder trust represents the perfect blend of philanthropy and financial planning. By leveraging this tool, you can secure your financial future, reduce tax liabilities, and create a legacy of generosity that benefits your chosen charities.

If you’re ready to explore the possibilities of a CRT, reach out to an experienced advisor today. Together, you can create a plan that honors your goals and leaves a lasting impact.

By understanding how a charitable remainder trust works, you can make informed decisions that benefit your loved ones, your estate, and the causes closest to your heart.

Ready to Start Your Charitable Remainder Trust?

IntelliVest Wealth Management can help clients with charitable remainder trusts and their investment management. Contact a us today to schedule your free virtual or in person consultation.

Disclosure

IntelliVest Wealth Management is a Registered Investment Advisor Headquartered in Spartanburg South Carolina. This is not a solicitation. Please consult with IntelliVest Wealth Management about your personal financial situation.